Got a Question? We Can Help.

Oostburg State Bank is committed to providing the most accurate information available so you can make smart financial decisions. If you have any additional questions, please give us a call at 920-564-2336.

Got a Question? We Can Help.

Oostburg State Bank is committed to providing the most accurate information available so you can make smart financial decisions. If you have any additional questions, please give us a call at 920-564-2336.

Frequently Asked Questions

Savings and Checking Accounts

Because of the verification necessary, you must set up your new account in person at one of our two locations.

Yes, with a few exceptions. Oostburg State Bank is Member FDIC, so all checking and savings deposits are protected by the FDIC. Some investment accounts are not protected, and therefore have additional risks. We are an Equal Housing Lender and an Equal Opportunity Lender.

Yes, but there are restrictions. As a parent or legal guardian, you can set up a custodial account for a child. You cannot create an account for anyone over the age of 18 without their knowledge.

Yes. You can access your money at anytime online, as well as through our network of fee-free ATMs. You can also use ATMs outside of our network, but there may be additional fees applied to each transaction.

You will be required to right your account and will be assessed a fee. We offer several account protection programs to prevent overdrawn accounts.

Mobile Banking

Text Banking

From mobile phones with text capabilities users can:

- View account balances

- View recent transaction history

- Locate a nearby ATM

- Text the # 96924

Mobile Web Banking

From mobile phones with web access users can:

- View account balances

- View recent transactions

- View pending transactions

- Receive text alerts on banking transactions

- Transfer funds between accounts

- Pay bills from your mobile phone

- Locate a nearby branch or ATM

Smartphone App

Same functions as Mobile Web Banking:

Go to the Google Play or Apple App Store and download the “Oostburg State Bank” app.

**Message and Data rates may apply

**Standard text rates apply

- Text Banking – Any text capable mobile device

- Mobile Web Banking – Mobile phones with Internet access

- Smart Phone APP – Selected smart phones can install a Mobile Banking App

- Log onto Online Banking

- From the Options menu, choose Mobile Banking Enrollment and complete the form

- Current Online Banking customers can also go directly to the Google Play or Apple App Store and download the “Oostburg State Bank” app.

The password used for Mobile Banking is the same as your password you use to log on to Online Banking. If you change your Online Banking password, your Mobile Banking password will also change.

Text Banking:

- View accounts by nicknames you set, not account numbers

- No detailed personal information is sent

Mobile Web and App security:

- 128-bit encryption masks your sensitive information

- Password is required each time you log on

Consumer’s private “picture and pass phrase” are displayed to protect against “phishing”

No software is required for Mobile Banking, unless you choose to download and install the optional Smart Phone App. Current Online Banking customers can access Mobile Banking Enrollment and Status information under the “Options” button located at the top of your Online Banking home page. Scroll down towards the bottom and refer to the “Mobile Banking Profile” section. You can also go directly to the Google Play or Apple App Store and download the “Oostburg State Bank” app

- View and modify pending payments

- Must be enrolled for our online bill pay service to access this feature

- Our standard bill pay fees apply for payments made from your mobile phone

- Mobile Web service is required for this level of service. Not available with our Text Banking option.

**Message and Data rates may apply

Bill Payment

You must be a current Online Banking customer. Contact us to learn more about getting started with Bill Payment.

Online Banking

If you have not already set up a PIN, you will need to contact the Operations Department at 920-564-2336 or e-mail generalbox@oostburgbank.com.

Your email address will enable the online banking system to email you your password should you forget it. We will not share your email address with anyone and you will not be solicited by the bank as a result of registering your email address with online banking.

After agreeing to the Terms and Conditions, you will need to create a username and password. For your username, use at least 6 to 12 alpha or numeric characters. For your password, use at least 8 to 17 alpha and numeric characters with at least 1 uppercase alpha character. Both the username and password are case sensitive.

Log in to Online banking. Click on “Profile” in the upper right hand corner of the page. Then click on “Edit” next to “Password”. Enter your current password into the “Current Password” textbox. Enter a new password into the “New Password” textbox and again into the “Confirm New Password” textbox. Use at least six 8 to 17 alpha and numeric characters with at least 1 uppercase alpha character. The password is case sensitive. Next click “Save”. You should receive a message indicating that your password was changed successfully. None of the bank’s personnel will know, or have access to your password.

You will choose your Username during the enrollment process. If you decide to change it at a later time, please contact our Operations Department at (920) 564-2336 or email generalbox@oostburgbank.com.

A Challenge Question and Answer is a form of personal identification that involves a “shared secret”. The authenticating party (the Bank) seeks to verify the identity of a transaction initiator (the Customer) via a question that only an authentic customer should be able to answer. You will be asked to set up 3 challenge questions and answers during the initial enrollment process. To change a question and answer, log in to Online banking. Click on “profile” in the upper right hand corner of the page. Then click on “edit” next to “challenge questions”. Choose a question from the drop down box and put the answer in the next text box. Click “Save” when you are done with your changes.

You can access through virtually any web browser, including Google Chrome, Apple Safari, Mozilla Firefox and Microsoft Edge. We recommend that you update your browser to the most current version.

PDFs can be viewed using a number of applications, including Adobe Acrobat Reader.

You can log in to Online Banking through any page on the Oostburg State Bank website. Look for the Login link at the top of the page.

Check Images

The following allows you to retrieve images of checks that have cleared up to the past 60 days:

- Log in to Online Banking

- Click on the account you would like to see. This will bring up your transactions.

- Under the “Description” column, click on the check number of the check you’d like to see.

- If you do not see the check you are looking for, click on “more transactions” at the bottom of the page OR you may use the “search transactions” on the right-hand side of the page.

Your transaction appears on your Online Banking statement in “real time” as soon as your check is processed. Your check will be available for viewing by 10:00 am the following business day.

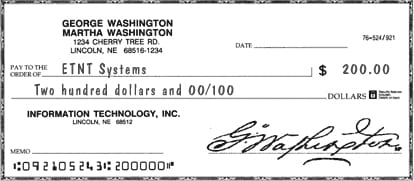

This is a replica of a check that has cleared

You can view your checks for 2 years after they clear.

Click on the picture of the printer either at the top or bottom of the image.

eStatements

An eStatement is an electronic statement. It is an exact replica of a paper statement, except that it is available through Online Banking. As soon as your statement is prepared, it appears on Online Banking. It replaces the paper statement sent through the mail.

You must be a current Online Banking customer.

Yes. Only one account from the combined statement need be listed. If you receive a separate statement, then that account number would also have to be enrolled. You must be an account owner to receive these

Yes. Contact us to sign up now.

Combined Statements: Customers who prefer to see all of their accounts on one statement choose combined statements. With eStatements, Online Banking will send an email to you when your statement has arrived instead of a statement via mail. Next, you can log into Online Banking, select your checking account, and a “Documents” button will be available. Clicking the “Documents” button will provide a list of sixteen (16) months of statements available for viewing. All of your combined accounts will be on this eStatement. (Some accounts may not be eligible for combined statements.)

Any account that is on a combined statement will only be viewable through the primary checking account.

Separate Statements: If you prefer to view a completely separate statement for each account, you will need to enroll each account separately. Instead of receiving a statement via mail, Online Banking will send an email to you when your statement has arrived.

Log in to Online Banking to view the eStatement, then select the particular account you’d like to view. Click the “Documents” button, and a list of the eStatements will appear. Select the month you would like to view.

Yes. Use the print button available on your browser. This printer friendly version will look exactly like the statement you had been receiving in the mail.

Your eStatement will remain on Online Banking for up to sixteen (16) months.

Yes. Each of your eStatements will be listed separately and will remain available for up to sixteen (16) months.

First, try again. As with any page request over the internet, there is a chance that the server is busy.

If you are enrolled and continue receiving this message after the time when you normally would have received a statement, call 920-564-2336. We will verify that the account you are trying to review has been enrolled.

If you choose a combined statement so you can view all of your accounts in one click and a single print, then your eStatements will appear under the main checking account only. All other accounts that had been requested to be on the Combined eStatement will receive the message “No Documents Are Currently Available For Viewing”.